What Is Debt Consolidation?

Statistics has shown it to be one of the best ways when it comes to financial restructuring.

In real life situations, many have found themselves doing debt consolidation with or without their knowledge.

Let us now dig deep into debt consolidation process and some of the importance it has in terms of finances.

What Is Debt Consolidation?

It has had different views from different people but we shall give it a more general and convincing definition. Debts can vary from the little bills we pay from our daily consumption to major ones like car loan and mortgages.

In a situation where you have more than one debt of smaller amount to pay and each being independent in terms of payment and interest rate from each other, you can decide to bring them together.

All your debts now come under one umbrella with new terms of payment as agreed by the lender.

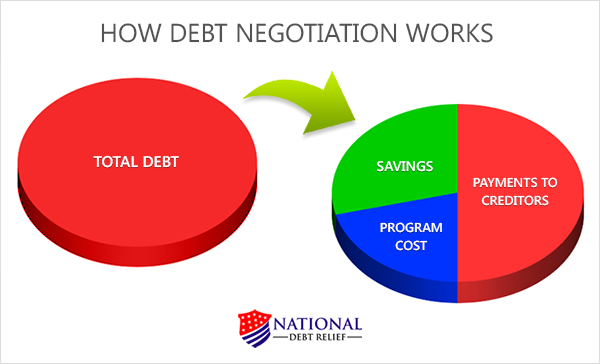

In most cases the total value of the smaller debts are calculated together with the interest and the exact amount given as loan to pay off all the existing debts.

How Does Debt Consolidation Work?

Debt consolidation is a technical way financial institutions and other lenders use to give their clients easy time to pay the debts.

The process of loan consolidation is complex but once adopted it brings relief to the borrower.

It is best on transparency and trust and before you make a decision to approach your lender for debt consolidation, you must first start by identifying all the outstanding debts.

You then declare the value and if taken from different sources, you declare the sources as well to the best lender who then gives you a fresh loan. The fresh loan (debt) should be equal to the exact value of the smaller debts you had identified plus any other related charges.

If the loan is with the same lender payment is facilitated directly and in most case you never get to touch the money but carry home a document that declares all your existing debts paid and a new loan given.

If the smaller debts are from different sources or lenders, the consolidating lender facilitates the payments on your behalf to the right destinations.

They ensure all your debts are paid and ensure you have only one debt that is currently running with them.

Factors That Can Lead To Debt Consolidation

1. When there is a challenge with servicing the many smaller debts, debt consolidation can be important.

2. In case there is a reduction in interest rate from the existing one you can consider debt consolidation to pay the debts at a new favorable interest rate.

3. Can help increase the period of loan payment hence reducing the amount paid monthly making it possible to save.

Whether debt consolidation is good is a fact that cannot be dismissed. It has a lot of advantages and has changed both the lives of people and economy of countries.